President Donald Trump has said he wants to spend $1 trillion fixing America’s beat-up, broken-down infrastructure. The goal is ambitious, and one of the few administration initiatives that enjoys a measure of bipartisan support. But there may not be enough capital in the United States to pay for all that infrastructure. The solution could come from an unlikely source – China.

David Firestein, founding executive director of the China Public Policy Center – launched this week at the LBJ School of Public Affairs at The University of Texas at Austin – says China is a likely investor in U.S. infrastructure projects because the country’s private sector is the world’s largest source of capital currently looking for investment opportunities.

Firestein says the U.S. investment sector, along with other countries, could provide some of the needed funding, but that China is the world’s single largest potential investor.

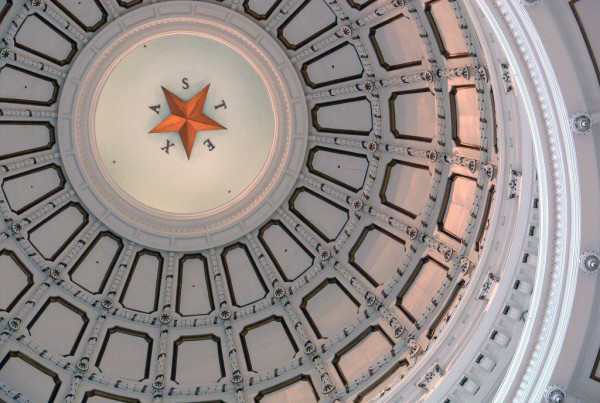

In a Fortune Magazine commentary, Firestein writes that Texas offers “the most obvious and urgent opportunity” for Chinese investment in U.S. infrastructure. Reconstruction in the wake of Hurricane Harvey presents an immediate need for large amounts of capital, he says.

“There was an incredible level of devastation wrought on our fellow Texans in Houston and the surrounding areas,” Firextein says “and that’s obviously a case where any help…to get that great city and get people back on their feet is definitely something that I think is worth putting at the top of the agenda.”

Firestein says Chinese investors would likely have several objectives for backing U.S. infrastructure projects. Aside from achieving an economic return, diversification is important to Chinese financiers.

‘Opportunities to invest in stable, predictable markets like the United States, which is one of the most mature markets in the world, are welcome,” Firestein says.

Firestein says investment in the U.S. could also benefit political relations between the two coutnries.

Written by Shelly Brisbin.