The energy sector has been hurting this year, but a new survey from the Dallas Fed says things may be stabilizing – a bit. While industry activity continues to decline, it is doing so at a slower pace. This comes after a major blow from the pandemic, and, more recently, an abnormally active hurricane season.

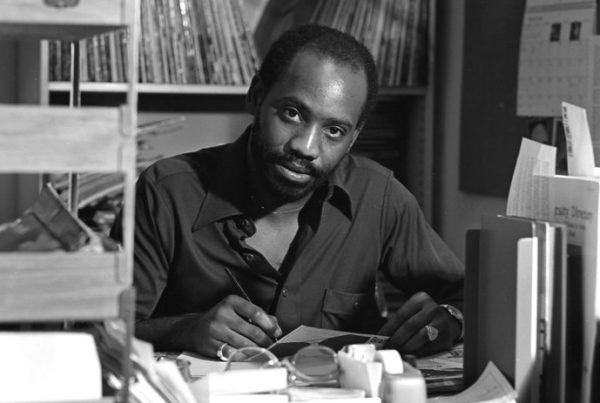

From storms to surveys to solar, when we want to learn the latest goings on in the energy industry we turn to insider Matt Smith, director of commodity research at ClipperData.

The storms

The worst of the Atlantic hurricane season may be behind us, but the energy industry is still feeling the effect of past storms.

“While we still could see further storms forming in the next few weeks, topical activity really should start dropping off sharply as we get into the latter half of October,” Smith said. “That’s the good side of things. All that said, energy infrastructure is still being impacted particularly by Laura and Marco that happened back in August… We’ve got operations that are still trying to restart. Lake Charles refineries are still suffering from power outages there, and the Cameron LNG terminal in the same area which is struggling with the same issue.

The survey

The Dallas Fed released their Energy Survey late last week, which collects responses from oil and gas companies about business activity and other economic indicators.

“These oil companies surveyed got to choose what was their primary goal. And it was maintaining production as opposed to reducing costs or reducing debt, so I think what we can gather from that is that the cost cutting element of these businesses have already been done,” Smith said. “So now they’re shifting their focus to business activity and to keeping cash flow coming through as much as possible.

“Another one, and this is kind of crazy, was that 91% of responded expected it would take an oil price of 50 dollars or higher for a substantial increase in the US oil count. These guys are saying they need a price 25% higher than where we are now to see drilling activity really increasing.”

The solar industry

While wind power gets a lot of attention in Texas when we talk about renewables, solar power is starting to slowly catch up.

“Solar is no slouch. The ERCOT interconnection queue – essentially planned power capacity – is dominated by solar,” Smith said. “So even though not all of the planned capacity will come to market, the amount of planned solar capacity is 3 times that of the next energy source, which is wind. So while wind has been this growing source over the last few years, looking ahead, solar is going to be catching up to it.”