How have you adjusted your spending habits in response to rising prices over the past year? Email Andrew Schneider at andrews@houstonpublicmedia.org or contact him on Twitter @aschneider_hpm.

The latest Household Pulse Survey conducted by the U.S. Census Bureau revealed roughly four out of five Houstonians are stressed out about recent price increases. This raises the question of whether Houston still deserves its long-held reputation as one of the most affordable large cities in the country.

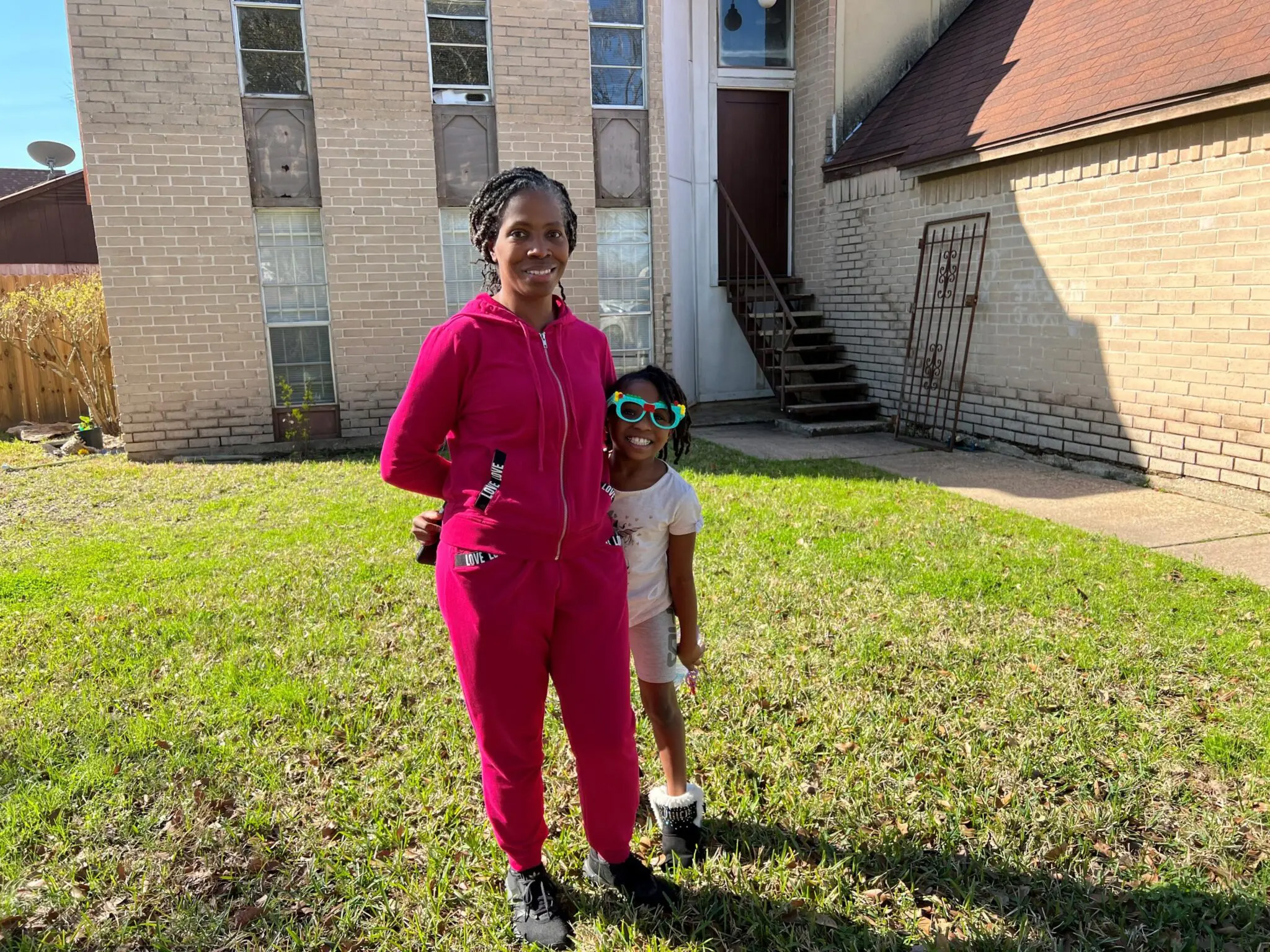

Housing is typically the largest expense any Houston-area resident faces and is the key factor in determining affordability. For this reason, changing homes can be an extremely stressful event, right up alongside changing jobs. Manda Rogers recently did both.

“I literally got the keys for this house on Friday,” Rogers said, standing in the bare dining room of her new home in Southeast Houston on a recent Sunday afternoon. The power hadn’t been turned on yet. She and her two children had just moved from an apartment in the Alief area, where Rogers is a first-year teacher.

“I was looking for a house that I can afford,” Rogers said. “I wanted the kids to have their own bedroom and stop fighting over space in one. And I grew up in this area, many, many moons ago.”

While Rogers was able to afford the mortgage, her new home came with a tradeoff that pushes her budget to the edge affordability.

“I was working with some counselors on trying to get into a house that was 30% of my income,” Rogers said. “Right now, I think I’m sitting at like 40-45% with the taxes and stuff included.”

That’s still a smaller portion of her salary than Rogers was paying to rent her former apartment. “Actually, my rent just went up in Alief to $1,100,” Rogers said.

So, Rogers is saving money, but she’s still paying at least 40% of her income on housing. The U.S. Department of Housing and Urban Development (HUD) defines as “cost burdened” anyone who spends at least 30% of their household income on rent, mortgage, or other household needs. Plus, Rogers took on a new expense when she moved.

“I was spending about $50 a week commuting back and forth to work,” Rogers said. “Now it’s probably going to be close to $70, because the commute is a little bit longer.”

Rogers owns her car outright, but it’s getting along in years, and she worries she’ll have to replace it at some point. Meanwhile, there are many other transportation-related bills to pay. On top of gas, oil, and tolls, there’s the monthly insurance premium and regular maintenance expenses. She estimates all that adds up to 20% of her income.

And what happens when the electricity in her new home is turned on?

“My lights have been about $300,” Rogers said. “I have an estimate of the gas and water, and that’ll be about another $100.” That’s another 10% of her income for utilities.

As a teacher, Rogers’ health insurance is deducted before she even sees her paycheck. For her and her two children, that’s another 5%. And they haven’t eaten yet.

“I have been utilizing food pantries and other resources to kind of cut down on costs for food,” Rogers said.

All told, we’re looking at more than 75% of Rogers’ household income spoken for, leaving little for emergencies or future purchases. As a homeowner, though, she’s in a relatively good position.

“Renters are twice as likely to be burdened by housing as homeowners,” said Nadia Valliani, director of community philanthropy at the Greater Houston Community Foundation. “And specifically in Harris County, one out of every two renters spend at least 30% of their income on housing alone. That’s about 400,000 households. And half of those spend at least half of their income on housing.”

Renters are at a disadvantage not only here but in other major cities across the country.