If you’re the investing type, it’s likely the stock market has given you a little bit of whiplash in recent weeks. If you’re not the investing type, you’ve probably seen the major ups and downs as a reason to avoid stocks. Ups and downs are par for the stock market course, but has the recent volatility been an outlier? And what explains it? President Donald Trump said this week there was a “glitch” in the market December, so what are we to make of that?

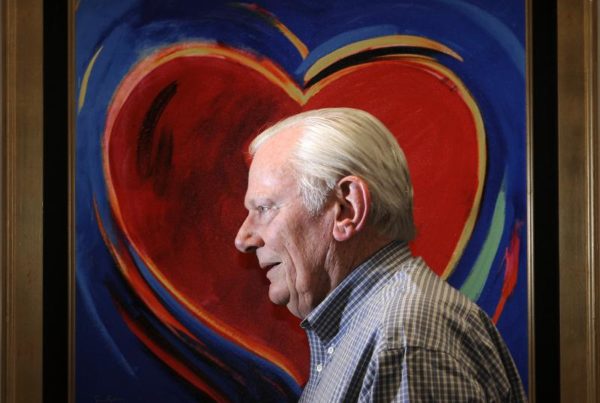

Ray Perryman is an economist with the Perryman Group in Waco. He says the stock market’s current fluctuations are unusual.

“This has been a pretty exceptional period,” Perryman says. “Just the extreme swings of sometimes 500, 600, 800 points in a single day in both directions, with a definite downward trend.”

Uncertainty has played a big role in the market’s volatility, Perryman says, and investors don’t like uncertainty. He says the list of issues unsettling investors includes trade disputes, Brexit in the U.K., Middle East tensions, change in South American governments and investigations related to election interference in the U.S.

Perryman says it’s too early to worry about a possible economic downturn. He says the underlying U.S. economy is strong. Elsewhere, China’s economy has slowed, causing problems for U.S. companies that trade there, and European economies are also facing difficulties.

“The trade policies that we’ve put in place – the tariffs and that sort of thing – are starting to have some effects,” Perryman says. “We’ve seen that just recently with Apple’s announcement that their sales are falling sharply.”

Perryman suggests “keeping an eye” on the U.S. economy. Individuals with long-term investments should to feel confident in the stock market’s ability to provide positive returns. But for those making short-term investments, like a few months, it’s not a good time to be in the market, he says.

“Over the long term, I think U.S. companies are very competitive in the world,” Perryman says. “They’re very good at innovating and bringing out new products and new technologies. And so, I think there’s a lot to look forward to down the road.”

Perryman says the outlook for Texas’ economy is positive, too, starting with energy production in the Permian Basin. He says the tech sector, business services and biomedical services are also bright spots for the state.

“I don’t think we’ll grow as fast as we did last year,” he says. “Frankly, I don’t think it’s sustainable. … But I do think it will be a very positive year in which Texas outperforms the U.S. economy by a pretty significant margin.”

Written by Shelly Brisbin.