Affordable housing is always a problem in the Lone Star State, especially for low-wage workers.

But as Dallas news station WFAA-TV reports, banks are getting a pass by the feds when it comes to meeting their responsibility to create affordable housing options in low-income neighborhoods.

WFAA reporter David Schechter took a look at several south Dallas apartment complexes financed and owned by banks in an area that has few banks to begin with, just south of Interstate 30.

It’s an area populated by several check-cashing businesses, crime and a lot of poverty, and it’s there Schecter began looking at how banks were complying with the little-known Community Reinvestment Act. Since 1977, banks have been encouraged to invest in low-income communities in exchange for government tax credits.

“It says banks can’t just lend money to rich people; they have to lend money to low-income communities,” he said.

What the WFAA investigation found is that banks were financing large, dense apartment complexes in this area instead of lending money to potential homebuyers. Banks told the news station that they were proud to invest in housing in low-income neighborhoods, but none would agree to be interviewed about their track record, Schechter reported.

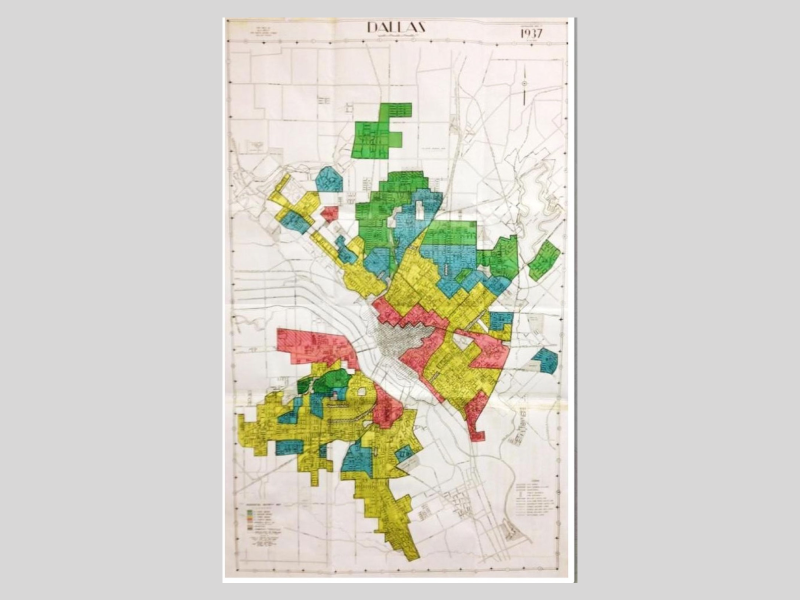

“We found that they continue to draw red lines around the high minority population and not lend money,” Schecter said. “On the face of it, I guess that’s probably OK, except they’re not following any of the rules. They’re putting these apartments in places where people have no opportunity to thrive, or the crime is high, or there’s blight, where there’s no opportunity to go to a high- achieving school. And the government saying, ‘Hey, good job, congratulations.’”

The spirit of the act was an attempt to end redlining of neighborhoods. That’s the discriminatory practice of not offering a set of resources to one geographic area that are available elsewhere and that help residents break out of poverty.

One reason for this is that by the 1990s, WFAA reports, regulators changed the rules so banks don’t just get credit for making loans directly to individuals. They also give them what you might call “extra credit” for investments in affordable housing.

“You know, you have generations of low-income families, some largely minority families, in southern Dallas that have not been able to get loans,” Schechter said. “They have not been able to buy homes, have [not] been able to invest in their businesses.”