KERA’s One Crisis Away project focuses on North Texans living on the financial edge.

People saved a ton of money during the pandemic. That didn’t necessarily increase their wealth

At the height of the pandemic, Americans saved a lot of money. Wealthier households turned that increase in savings into increased wealth. But for a lot of lower- and middle-income people, building wealth has been much harder.

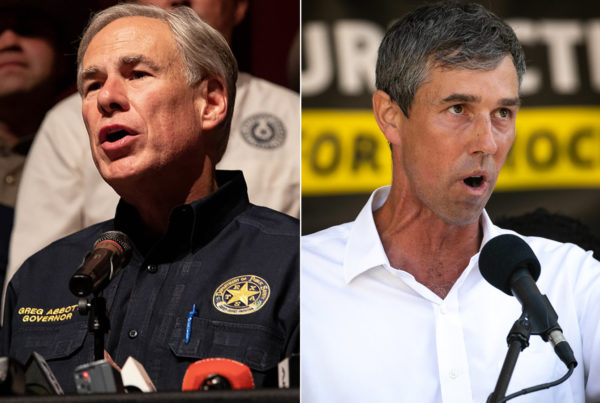

Anita Moti / KERA

For families with lower incomes, savings don't often last long to increase their wealth. That's especially true when a lot of jobs don't generate reliable income, and for families of color facing additional impediments related to racial wealth and income gaps.

From KERA:

Leigh Phillips has had a unique window into the pandemic’s impact on household finances.

Phillips heads the nonprofit SaverLife, which helps people build savings using incentives on the program’s app to, basically, make saving and budgeting into a game. SaverLife’s 600,000 clients are mostly women, many are mothers, and they’re mostly lower income.

When COVID-19 hit, Phillips saw how the shutdowns and work disruptions upended client finances. She was able to track how waves of federal financial relief, like stimulus payments and expanded unemployment benefits, helped people stabilize.

Then, in the second half of 2021, monthly payments from an expanded child tax creditstarted landing in bank accounts. Even as inflation was heating up, her clients were able to get by.

“That was an incredible boon for the families of SaverLife,” she said. “During that period of time, savings balances remained stable, even though expenses were going up, but also people were keeping up with their bills.”

Short-term gains

SaverLife’s clients put an average of $8,000 into savings accounts in 2021, four times the amount they saved in 2019. But that still only translated to about $200 in increased wealth at the end of the year.

A fast-increasing cost of living ate away at savings, Phillips said. But the nature of many lower-paying jobs is also to blame.

For a lot of workers, earnings can vary by several of dollars each month, depending on how many hours they work, the tips they earn, or if they have to take unpaid time off for illness or to cover childcare. So, Phillips said people are most often “saving for soon” – they build savings to manage the next income shortfall or the next major expenses, like car repairs or back-to-school purchases.

“When you have more, you put some away as a buffer against what you know is coming,” Phillips said. “People save their tax refunds, they save the stimulus checks, they put money into savings when they can. But it’s not resulting in gains in wealth because people’s finances are such a roller coaster.”

Looking for help

Now, with inflation slamming American wallets, family budgets are stretched thin. In response, personal savings rates nationally are now well below pre-pandemic levels, and more people have been turning to friends and family to make ends meet.

About 30 million people borrowed money from loved ones to get by in early July, according to the most recent Census Bureau snapshot of people’s financial hardship during the pandemic indicates.

“Millions more in 2022 are borrowing from friends and family than before, which to me can mean a couple of different things,” said Joanna Smith-Ramani, managing director of the Aspen Institute’s Financial Security Program.

First, it’s a clear indication that families are facing increased financial stress.

“You don’t borrow if you have your own money,” she pointed out. Also: “These may be families who don’t have access to the credit card market or have maxed out what they can [spend on credit cards]. So that’s a red flag for me.”

The Census Bureau data also shows Latino and Black households turning to friends and family at twice the rate of whites.

The racial wealth gap

University of Texas law professor Mechele Dickerson said this kind of borrowing is a lifeline for many families, but it is also made more necessary by deep divides in wealth between Black and Latino families and their white peers.

“What that means is that the people that you are borrowing from are not rich, so you have poor Blacks going to their cousins who are slightly better off to borrow money from them,” Dickerson said. “The money may be cycling through the family or the community, but no one’s actually acquiring wealth.”

Dickerson, who teaches courses on COVID-19, race and class, said the pandemic has turned into another dismal chapter in the nation’s persistent racial wealth gap, undoing much of the gains made since the Great Recession wiped out decades of progress toward closing the disparities.

Without the wealth that helps buffer economic shocks, many lower- and middle-income people are forced to take on additional debt, which then requires more income directed to paying debt instead of savings.

So far, federal aid programs appear to have staved off the widespread financial distress seen in the Great Recession when delinquency rates, foreclosures and bankruptcies spiked. But Dickerson said additional debt from the pandemic, especially from credit cards or other higher-interest products, can make it much harder to accumulate wealth for those who are not already wealthy.

“It’s a slow bleed,” Dickerson said.

While upper-income households have seen their wealth grow tremendously during the pandemic, many lower- and middle-income households aren’t much better off. And they’re being hit hardest by increased housing costs and higher prices for energy and food. Many are putting more on credit cards to get by.

“We know that we live in a two-tiered financial system. We know that we live in a financial system that is designed for the success of some, but not for the success of all, said Leigh Phillips. “And we really need to be to be looking at how this economy is affecting lower income people.”

She said pursuing policies that help working people save while also making incomes more stable will help them not just weather economic challenges ahead. If they’re done right, they could also help people build wealth for the future.

Afterall, that’s what SaverLife’s data suggests.

If you found the reporting above valuable, please consider making a donation to support it here. Your gift helps pay for everything you find on texasstandard.org and KERAnews.org. Thanks for donating today.