From KERA:

How does something like that happen? It’s complicated.

Many schools in Texas are primarily funded by local property taxes, plus money from the state and some federal dollars. But wealthy school districts don’t get to keep all of their property tax revenue. The state sets a basic amount of funding school districts get per student — it comes out to no more than $6,160.

School districts like Plano ISD that collect more than that in property tax revenue have to send the extra money to the state. The Texas Education Agency redistributes that extra money to poorer school districts. That system is known as recapture.

But Plano ISD says it needs to spend more money to fund its district than the basic amount the state allotted. That’s why it’s running on a budget deficit.

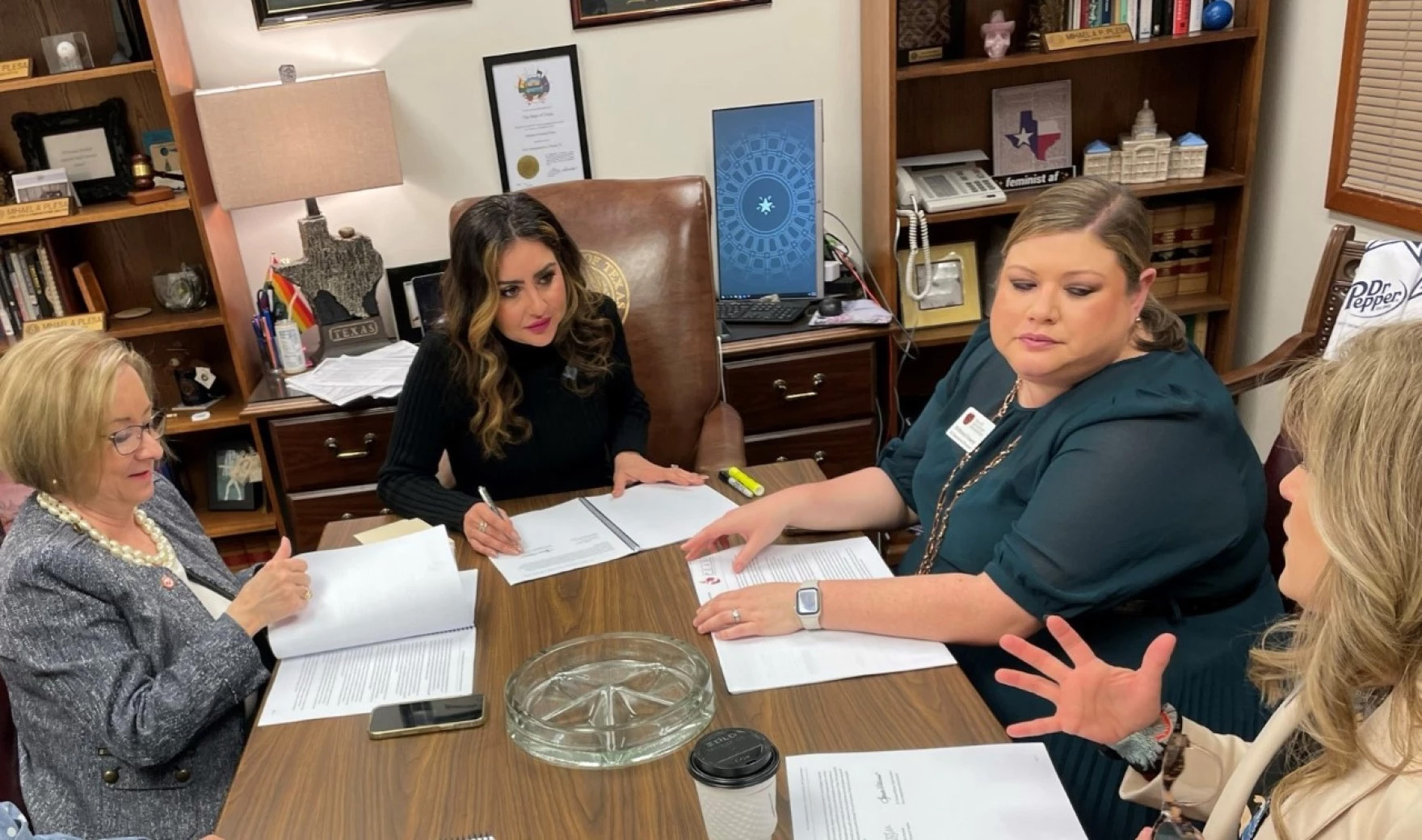

If the district could keep more of its property tax revenue, that deficit could be eliminated. Texas House Representative Mihaela Plesa from Plano has filed legislation she said would help.

Plesa, who filed five bills on this issue in early March, said poorer school districts wouldn’t receive less funding because of her legislation. Instead, she said the leftover funds from wealthier school districts wouldn’t be redirected to the state’s general fund to pay for expenses that may not be related to education.

Plano ISD officials say the district has paid $2.4 billion in excess property tax revenue to the state since recapture became law in 1994 after a lawsuit. Johnny Hill, the district’s chief financial officer, said the district sent about a quarter of a billion dollars in recapture payments this year. Those payments were about a quarter of the 2022-2023 budget.

Chloe Latham Sikes is the deputy director of policy at the Intercultural Development Research Association, a nonprofit that focuses on education access in public schools. She said recapture helps make education in Texas equitable.

“We’re very diverse and we have a lot of different varying property wealth across our districts,” she said. “And so, it really acts as the key mechanism to equalize that.”

Out of control?

But opponents of the recapture system say it’s gotten out of control, collecting more money than is necessary to fund education. That includes Plesa.

Plesa said the school financing system is well-intentioned and shouldn’t be eliminated. But she said it needs reform to lessen the negative impact on districts like Plano that pay into it.

“We have created a system that, essentially, is unsustainable,” Plesa said.

Rising property values in wealthy districts like Plano means recapture payments have gone up, but the money school districts get from the state hasn’t changed. And there’s debate on where the excess recapture funds sent to the state end up.

Plesa said the money goes to the general fund, leaving public education. That’s why she filed a bill that would ensure excess property tax revenue collected from school districts stays in public education. It was referred to committee last week.

While Plesa said the money goes to the general fund, that’s a topic of debate.

Michael Meyer is the deputy finance manager for the Texas Education Agency. He said the money already stays in public education. He said the belief that the money goes to the general fund is a common misconception.

“That’s not how it works,” he said. “They come to TEA, and they become part of the pool of funds that we use to make payments.”

Sikes also said the money stays in education — but not in school districts. She said the state also contributes money to charter schools, close $5 billion a year.

But Christy Rome, the president of the Texas School Coalition, said the state budget is a “black hole,” making it difficult to track where money goes. She said recapture funds were used last session to balance the state budget. This year, Rome said the money contributed to the state’s $32.7 billion budget surplus.

Plesa said she has heard these conflicting accounts about where the money ends up. She said that’s why she’s filed a bill for “taxparency” that would lay out where taxpayers’ dollars end up on their bills.

Stifling Inflation

School districts in wealthy and poor areas are feeling the impact of inflation on their budgets — Hill said Plano ISD’s budget increased as inflation grew. The district gave its teachers a 4% raise this past year, but Hill said that’s only half of the rate of what inflation was at that time.

Hill said retaining quality staff is a struggle in Texas.

“Everybody’s trying to chase each other because there’s a limited amount of quality staff here in teachers and support staff,” he said.

Boles ISD, a rural district about an hour east of Dallas that serves close to 500 students, is seeing similar issues. More than 96% of the district’s $7.5 million budget is funded by the state according to the TEA.

The district’s superintendent, Mikayle Goss, said her staff has been hit hard by inflation. But the district isn’t able to offer pay raises like Plano ISD. Goss said she worries her staff will leave the district for a wealthier area that can offer pay raises that keep up with inflation.

“I don’t know how our staff can keep food on the table,” she said. “It’s very difficult for them to keep up with the living expenses.”

Representative Vikki Goodwin from Austin has introduced a bill that’s in committee that would adjust school funding for inflation. Austin ISD is a property-wealthy district. The district estimates more than half of the property taxes it collected for the 2023 fiscal year went to recapture payments.

Plesa is a joint author of the bill. She said this would fill a gap in House Bill 3 that passed in 2019. It decreased the amount of money recaptured that year statewide from $3.6 billion to $2 billion, according to the TEA. But Plesa said the bill didn’t account for the impact of inflation going forward.

Rome said the rate of inflation has increased by 14.5% since 2019.

“Since that bill passed, with the exception of federal funds meant to provide for COVID relief and address learning loss, funding for schools has remained stagnant,” she said.

Goss said adjusting for inflation would make a difference for her district. It would also help Plano ISD. Hill said that would add about $30 million to the district’s budget, which would help eliminate the district’s budget deficit.

Plano ISD has been running on a budget deficit for about three or four years. Hill said the district built up a strong savings account thanks to years of prudent financial management, but that money will run out.

“If nothing changes, and we continue to run on a deficit, we’re actually eating into our monies that we need to support our own operations in about three years,” Hill said.

Operation costs for the district are growing as the student body’s needs change. Hill said the number of at-risk students is increasing.

The district has also seen a huge increase in students experiencing homelessness, known as McKinney Vento students. The McKinney Vento Act authorized a Department of Education program that aims to barriers to education for students experiencing homelessness.

James Thomas is the district’s community services coordinator. He said there were 966 McKinney Vento students last school year. The district used to have about 400 or 500 McKinney Vento students a year. There’s around 750 as of January, and the district isn’t done identifying students in need.

Goss said her district is also seeing more McKinney Vento students and others in need. She said there was an increase of about 12% of students signing up for school lunch assistance.

Hill said educating students in need costs more money.

“Our district has always been the kind of district that if we identify a student that has needs, we’re going to go out of our way to take care of those needs, even if it is more expensive,” Hill said.

Hill said Plano ISD may have more needs, but it still wants to give back and be a part of equalizing access to education in Texas.

“We believe that everyone in Texas deserves an equal education, and we’re in favor of that,” Hill said. “What we’re not in favor of is that’s being hamstrung by how much we get to keep our taxes per student.”

That’s why Plesa has proposed legislation to change the recapture system and keep more property tax revenue in district. The bill was referred to the public education committee.

But Sikes said there’s another solution that would give more money to schools without changing recapture payments.

“A great way to get rid of recapture would be for the state to invest much more money in their share for public education,” she said.

Plesa said she’s in favor of doing that someday — but getting it passed is another thing.

“I would love to see something like that in the future if we could get some support for it,” she said.