How much of a difference did last year’s property tax referendum raising the homestead exemption to $40,000 make to your bottom line? Email Andrew Schneider at andrews@houstonpublicmedia.org or contact him on Twitter @aschneider_hpm.

Governor Greg Abbott identified lowering property taxes as his number one priority when naming emergency items in his state of the state address. The idea enjoys broad, bipartisan support in the Legislature, but the two houses are not on the same page on what form it should take.

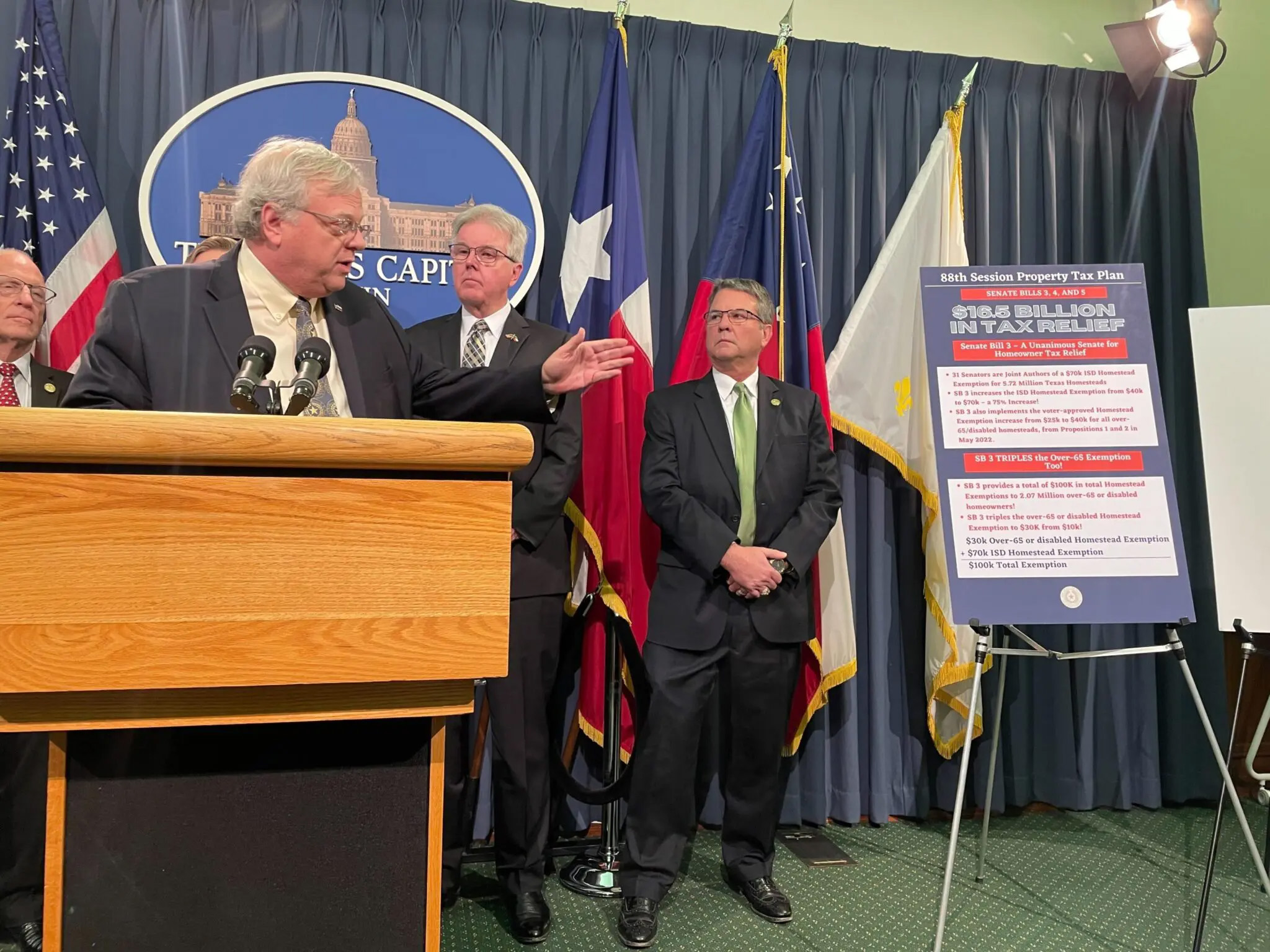

Last week, the Texas Senate passed a trio of bills aimed at lowering property taxes by a total of $16.5 billion, spending a significant portion of the state’s record $32.7 billion surplus.

“We’ve never had $16.5 billion to throw at property tax relief,” said State Senator Paul Bettencourt, R-Houston, who led the effort, “and I believe it’s going to be well received by the citizens, the taxpayers of the great state of Texas.”

The cornerstone of the effort was Bettencourt’s Senate Bill 3, which would dramatically increase the homestead exemption. “An exemption is the most powerful tool a tax writer has,” Bettencourt said.

Homeowners would only be taxed beyond the first $70,000 of their home’s value. That would come just one year after voters passed a constitutional amendment raising the homestead exemption to $40,000.

“And it’s going to even be higher for over-65 homeowners and disabled homeowners,” Bettencourt said. For seniors and disabled homeowners, SB 3 would raise the homestead exemption to $100,000.