From KERA:

When Dallas doctor Don Read enrolled in medical school at the UT Medical Branch at Galveston in 1964, he had to pay more than other students because he wasn’t a Texas resident.

“Back then I paid $500,” he says. “So things have changed a little bit since then.”

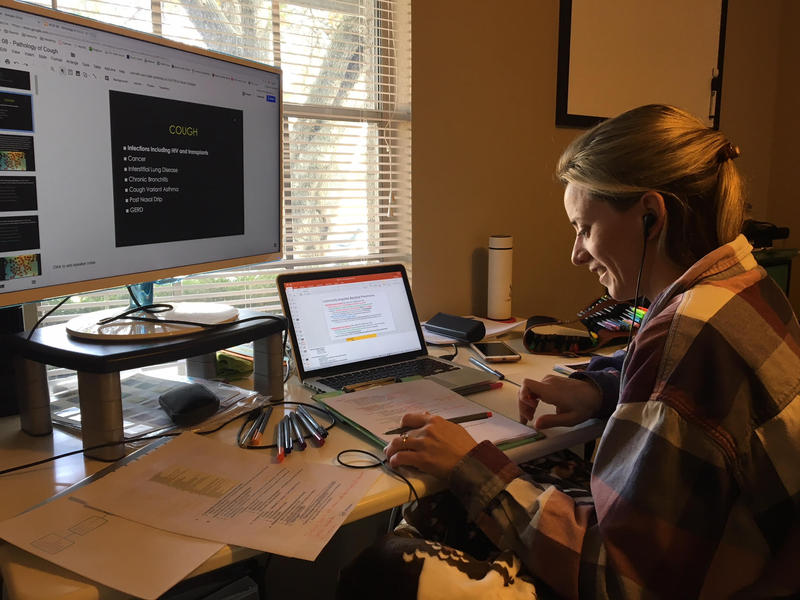

Take Kelly Johnson. She lives in Fort Worth with three other women in a single-story ranch house. The roommates are all students at the University of North Texas Health Science Center’s College of Osteopathic Medicine. And they’ve all taken out tens of thousands of dollars in loans.

“I think anybody that’s going into medicine, unless your parents are footing the bill, or you have some way of paying for it, you’re just expecting to be drowning in loans by the time you graduate,” Johnson said.

How doctors go into debt

Seventeen years ago, medical school grads owed an average of $125,000. Today, that average has climbed to $190,000, according to the Association of American Medical Colleges. Jim Dahle, an emergency physician who runs a personal finance site called The White Coat Investor, said he’s seen even worse.

“I’ve run into lots of doctors with $900,000 in student loans,” he says. “My record is actually $1.2 million.”

Racking up a million dollars in medical school loans is surprisingly easy, Dahle says.

“You basically just pay for [the] entire education on credit and let it run,” he says. “For example, if you went to an expensive undergraduate institution where the tuition was $40,000 or $50,000 per year, and you borrow the whole thing, plus your living expenses, you would start med school $200,000 or $300,000 in the hole.”

Then, four years of medical school could run you up to nearly $500,000; plus residency, where you’re not making enough to pay off the debt, and by the time you come out, it’s $1 million.

“And then if you’re a pediatrician making $150,000 a year, you’re in deep trouble,” Dahle says.

That’s one reason future doctors like Johnson, who’s originally from Southern California, are choosing to study in Texas.

“It’s remarkably cheaper,” she says.

Becoming a Texan to save money

It’s so much cheaper that Johnson bought a 1960s house in Fort Worth to help save on medical school. As a Texas resident, she’ll only have to pay $19,000 a year. That’s about the average in-state, compared to a national average of more than $32,000.

In fact, the least expensive public medical school is Texas A&M Health Science Center. And in the last few years, several new medical schools have opened in Texas, bringing the total to more than a dozen.

One of Johnson’s roommates, Morgan Neale, always dreamed of becoming a doctor. She came from a family of missionaries and was raised in Midland.

“I really lucked out in Texas,” Neale says. “Because there’s a lot of options here, and it is cheap, comparatively…dirt cheap.”

Even for an in-state student, Neale says the final price tag can be daunting. She racked up $50,000 in debt as an undergrad at Baylor. So, by the time she graduates, she’ll owe around $250,000.

Neale wants to study infectious disease and work in Kenya, a place she grew up visiting. But to pay off that $250,000 in loans, she estimates it will take her a decade.

“It does sound like a long time,” Neale says. “But a lot of the doctors I’ve shadowed and worked with have been in practice 20 years and are still making student loan payments.”

Why feel sorry for doctors

Dahle said people assume doctors make lots and lots of money, but that doesn’t mean they’re wealthy.

“When you owe three or four times your annual salary in student loans that basically eats up most of that disposable income that you have,” Dahle says.

Still, the public generally doesn’t have much sympathy for doctors with debt. Dr. Val Jones doesn’t either.

“I’m with the public all the way on this,” Jones says. Earlier this year, she wrote a blog post on her website to her colleagues:

“You sound like a bunch of whiners and kind of entitled brats, frankly, when you complain about the debt compared to the debt of others who don’t have the ability to get a high paying job when they graduate.”

In case you’re wondering, Jones finished med school at Columbia University with $250,000 in student loans. She says she lived frugally and eventually became a specialist in physical medicine and rehabilitation.

That’s an important point because specialists tend to earn more money than family doctors. Some earn as much as $400,000, whereas a primary care doctor pulls in half that. The low pay for primary care doctors is one reason there’s a shortage of these doctors in Texas.

Back in Fort Worth, Johnson says her roommates aren’t sure what their ultimate career in medicine will be. The only thing that’s certain is they’ll be paying off debt for years to come, albeit a little less than most med school students in other states.