By now you’ve heard of the great brick-and-mortar meltdown of 2017 – an “absolute apocalypse” for legacy department stores and smaller, hipper outfitters alike (we’re looking at you, American Apparel). But one segment has made it through the fray relatively unscathed: grocery stores. Turns out, everyone still needs to eat.

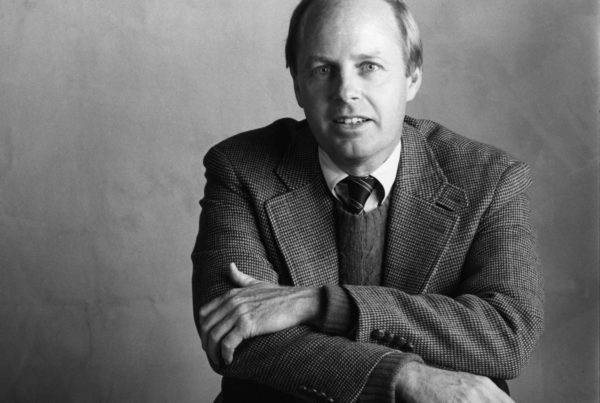

Those calm waters may not last much longer for the grocery industry, though. German discount grocer Lidl recently announced an expansion into the States on the heels of competitor Aldi. Lidl is eying Texas – one of the nation’s most competitive markets – for several locations. That could trigger some all-out price wars, putting regional chains in an even tighter bind. And that’s just one part of the equation, says Craig Giammona, food reporter for Bloomberg.

The shakeups will likely be noticeable in Texas, where competition is strong in the grocery sector. Texas added large amounts of grocery store square footage as real estate boomed, Giammona says. And although Amazon hasn’t made solid inroads into fresh foods yet, that’s not to say it won’t in the future.

“I think like a lot of things, people have looked to grocery as the safe place to be, but we know Amazon has big ambitions in space,” he says. “People are getting a little more comfortable with buying fresh food online, so five, ten years from now, we’ll see how this looks.”

It’s something of a perfect storm – new technology, new competitors promising bottom-dollar prices, plus an ongoing food price deflation streak unlike any we’ve seen since the 1950s, Giammona says. Profit margins are shrinking, and not all stores will survive.

But don’t mourn the loss of your favorite H-E-B just yet. Brands with large and loyal followings, like H-E-B, Wegmans and Publix, may weather the storm better than others.

“That is the question, is whether [Lidl] can crack that relationship that people have,” Giammona says. “That’s how the grocery business survives is repeat business – that person that goes every week and fills up the cart. It’s more sort of the midrange players that aren’t differentiating themselves, that don’t have great value or great produce and meat – those are the guys that really have to worry from these invaders coming.”