At a recent energy conference in Vail, Colorado, oil executives repeatedly echoed the question: “How do we get more out of our wells?” The urgency of that query is, of course, in response to falling oil prices which hit a six-year low earlier this week. Oil companies are responding by switching their focus from efficiency above ground, like drilling faster and operating 24-7, to making their wells more productive by using technology to find and exploit the areas richest in oil.

At the conference, Jim Brown, President of Western Hemisphere at Halliburton gave the example of a new product that could help with underground efficiency.

“We’ve developed a biodegradable diverting agent that we can pump in real time and direct that frack,” Brown said.

BioVert is a chemical substance that sends fracking fluid towards the rock formations with the most oil and gas. Brown claims that two operators in the Bakken started using this agent 6 months ago and they have already seen production go up 36%. He also added that Halliburton is now diverting most of the three quarters of a billions dollars that it spends on research and development each year to making its operations below ground more efficient.

In addition to efficiency, oil and gas companies are now more interested in drilling in the so-called sweet spots. That is a term loosely used by the industry to describe the parts of rock formations with the highest concentrations of hydrocarbons. These days, sweet spots are in high demand because the ‘recovery rate’ for oil is very low. According to the Energy Information Administration, producers generally only get three to seven percent of the oil out of any given well.

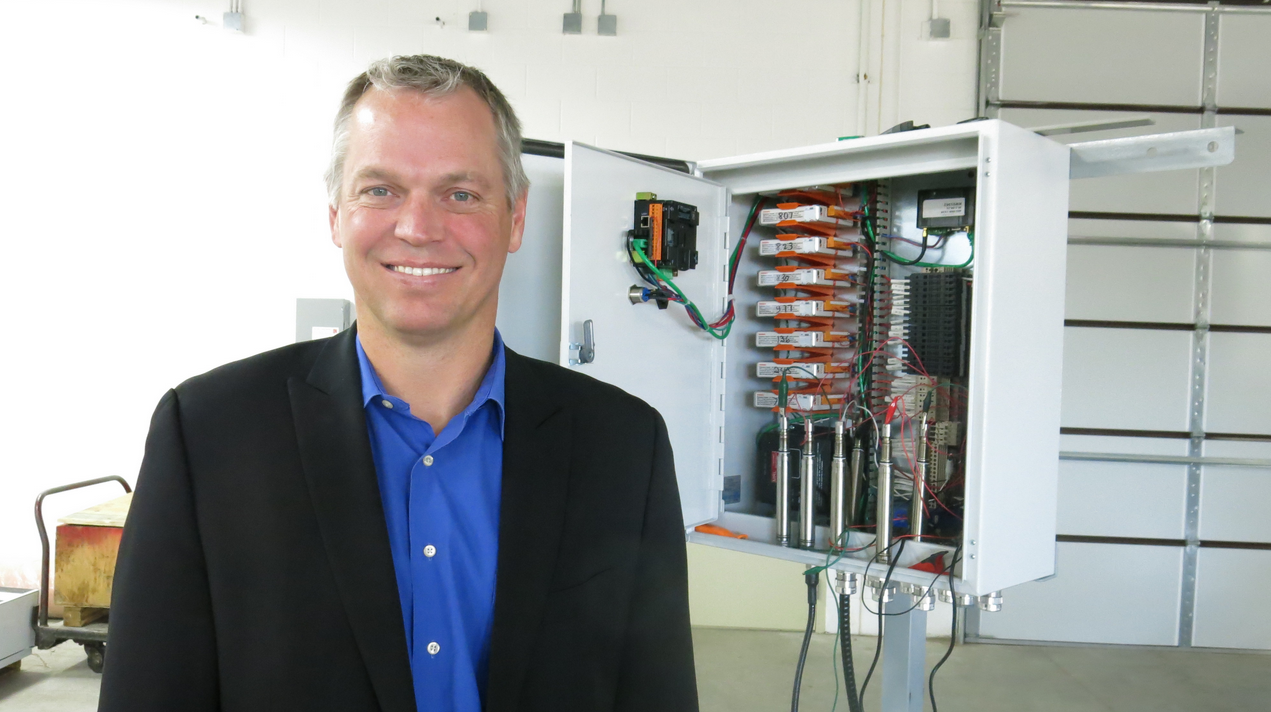

A Wyoming-based company called WellDog wants to help change that low recovery rate. It is an energy services technology company that specializes in products that help oil companies find and produce better wells.

One of WellDog’s most popular products is called WatchDog. (Yes, they are really into the canine metaphor – company headquarters are nicknamed “the Dog House.”) WatchDog is a sensor that collects data deep underground and then sends it up to a computer for analysis via thousands of feet of cable.

“That information can be used by the operators to do things such as indicate whether the well is healthy,” John Pope, CEO of WellDog told me.

WatchDog can also be used to indicate where to frack, and where not to frack. These days, that sort of information is necessary if you want to drill for oil. Last year, WellDog almost doubled its US workforce. And sales of the Watchdog product so far this year are already more than three times what they were for all of 2014. John Pope says while this sort of so-called downhole technology isn’t entirely new, the scramble to offset low oil prices is.

“In boom times, optimizing can lead to increased profits. In challenging times, optimizing can make the difference between profits and no profits,” Pope said.

It is too early to really know if all this technology and money is going to wrestle significantly more oil from the rocks. But consider this: although the US rig count is down nearly 40 percent since this time last year, this month, overall crude production in the U.S. is projected to go up.

This article was reposted with permission from Inside Energy.