Texas, a state that hates federal involvement so much that in addition to suing federal officials on a near-monthly basis, it built its own (faulty) power grid, is now taking a massive federal bailout for unemployment.

Texas House Speaker Dade Phelan and Lt. Gov. Dan Patrick announced last week they would put $7.2 billion from the Biden administration’s American Recovery Plan Act into paying back billions in loans the state took out from the U.S. Treasury — shifting the tax burden intended to be borne by Texas employers to taxpayers nationwide.

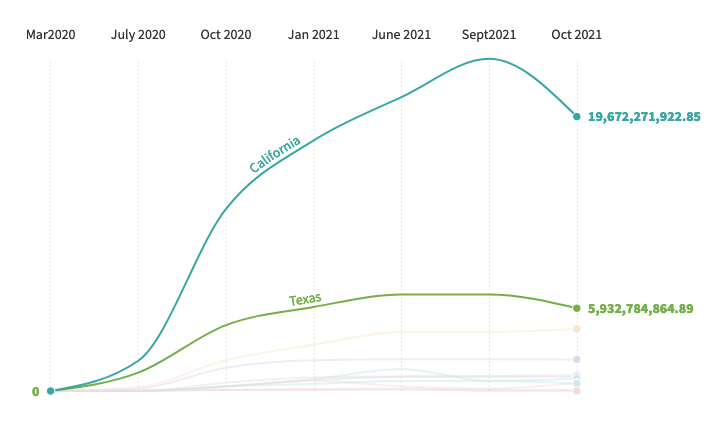

The state unemployment rates skyrocketed last spring because of the pandemic, climbing to nearly 13%. The state’s anemic coffers were quickly drained, and it began taking federal government loans. Then the federal government added additional monies on top through pandemic assistance for the unemployed. State and federal unemployment payments were more than $51 billion in Texas since the pandemic began.

The plan is to erase the state’s $5.9 billion in Title XII (unemployment) loans and add more than a billion to the unemployment trust fund. This nixes additional interest payments and allows the legislature and the Texas Workforce Commission — who oversees unemployment — to continue to avoid tough decisions about taxing appropriately. It allows the state legislature to continue on its business-friendly course, now at the expense of every other state.

“Texas has not had a solvent unemployment compensation trust fund since 1974. That’s one of the worst in the nation,” said Jared Walczak, vice president of state projects at the Tax Foundation.

The state will take that history of insolvency and unlike past recessions avert higher taxes on its own businesses by diffusing it to include out-of-state businesses and people.