This story originally appeared on Houston Public Media.

The Federal Reserve made little secret that it was leaning toward raising interest rates in December. When it finally did, Wall Street took the news in stride.

But one segment of the market got very jumpy just ahead of the Fed’s meeting. For two days, investors dumped huge volumes of junk bonds, particularly those for companies in the oil and natural gas business. The selloff may be a harbinger of fresh pain for Houston’s economy in the year ahead.

It wasn’t the ExxonMobils or Chevrons of the energy world that sparked the late revolution in oil and gas production. Small-to-midsize independent energy companies led the way into the shale fields of Texas. Hydraulic fracturing and horizontal drilling are expensive. And unlike the big oil firms, the independents didn’t have a lot of their own cash to risk.

“The transformational growth that was witnessed over the 2010 to 2014 period was heavily reliant on external sources of financing,” says Bill Herbert, managing director of Simmons & Company International, a Houston investment bank specializing in the energy sector. That financing, he says, “included a considerable expansion in debt, both in the form of bank credit as well as high-yield junk bonds.”

Junk bonds are called that for a reason. They offer a high-rate of return because the companies borrowing the money might not be able to pay it back.

The Fed’s decision to start raising interest rates may have roiled the junk bond market. But Herbert says that was a mere hiccup.

“What has happened and what is continuing to happen is that the cost of capital for the industry has risen almost exponentially,” Herbert says.

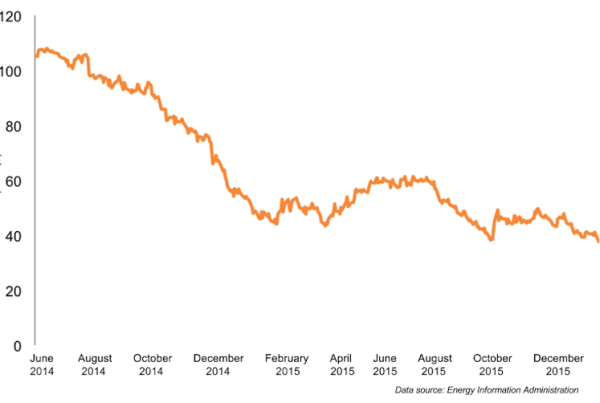

Companies that looked like a safe bet when oil was selling for close to a hundred dollars a barrel look anything but with crude selling below forty. Many independents are finding it tougher and tougher to pay their existing debts, let alone afford the higher interest on new ones.

“The collective viability of those companies as ongoing concerns is looking increasingly in question, and the longer this current purgatory persists, the more Darwinian the outcome is going to be,” Herbert says.

The result is that 2016 is likely to bring more mergers, more acquisitions, and more outright defaults.