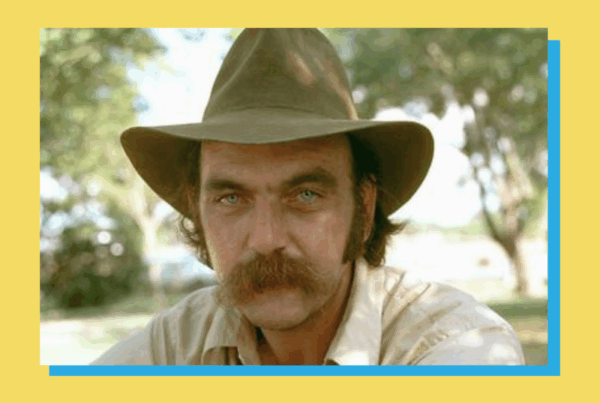

Every other week, Matt Smith, lead energy analyst at Kepler, joins Texas Standard for a look at what’s happening in the energy sector.

With 2025 rapidly coming to a close, we thought this might be the perfect opportunity to look back at the year that was in Texas energy, as well as a lookahead to what 2026 may hold.

Listen to the interview above or read the transcript below.

This transcript has been edited lightly for clarity:

Texas Standard: I know it’s a thing at year’s end to create top 10 lists. Alas, we don’t have time for 10, so let’s go with three – working up from No. 3 to No. 1.

What do you consider to be the third-biggest energy story for Texas in 2025?

Matt Smith: Oh gosh, I think in the top three, it’s got to be natural gas production and oil production hitting a record.

So with oil, we’re kind of pushing towards nearly 14 million barrels per day here for oil. To put that in context, Saudi Arabia is producing closer to 10 and they’re the second-largest producer. So oil production is going gangbusters and the interesting thing is it has continued to rise. People are expecting it to level off. And it just hasn’t happened yet, but we may see that next year.

We’ve also seen natural gas production hitting a record as well. And so the interesting thing is that even though we may see oil production starting to drop later next year, just because oil prices remain in check, natural gas looks like it’s just going to continue to chug on pushing to record levels.

What about exports?

Exports have hit a record for LNG. So we’ve seen new LNG terminals such as Plaquemines just pushing out a lot of LNG. There’s also the demand for it, right? I think about 70% of it is going to Europe because Europe’s trying to pivot away from Russia.

But on the oil side of things, we haven’t hit a record actually. So Europe has been pulling back a little bit, but we’ve had increasing competition into Europe. But one reason, actually, it’s been lower to Asia is because of tariffs. And so China’s purchasing has basically all but dropped off there.

You know, in any other year that might have been your No. 1, but let’s let’s now shift from No. 3 to No. 2. What’s your second-biggest energy story?

I think we’ve got to go with Texas power, and there’s a few bits here.

So the main one is really just the expectations of AI and data centers there. They’re going to be the largest component driving energy demand growth in Texas in the coming years here.

And you know what? It’s not just that. We’re going be seeing cryptocurrency mining, we’re going see hotter weather, a growing population. And so this is all why ERCOT, the state’s power grid operator, is predicting energy demand in Texas could well get close to doubling by 2030 there. So that’s ripping.

Just one last point on the power side of things, too: Solar is expected to surpass coal-fired power generation on annual basis this year. So it’s looking to account for 14% of power generation in the generation mix there just because it has absolutely ramped up like crazy this year and has overtaken coal.

» GET MORE NEWS FROM AROUND THE STATE: Sign up for Texas Standard’s weekly newsletters

Another huge story. How do you top those two? What’s your No. 1 pick when it comes to your top energy story for Texas this year?

Well, I think this is kind of timely, and it’s almost like a Christmas present, right? It’s the fact that prices at the pump are getting close to five-year lows here.

So for Texas, we’ve seen prices breaking below $2.50 a gallon there – so multi-year low. And so that gives some money back into our pockets here to be able to have a bit of fun around Christmastime. So I think that’s the winner for this year.

Yeah, this coming at a time when a lot of concerns are growing regarding affordability more broadly, getting to see those prices at the pump going down is a little bit of a bonus there. And obviously a lot of attention focused on what this might mean politically as we go into an election year.

Speaking of 2026, Captain, want to go out on a limb and make any predictions? What’s the next year looking like when it comes to Texas energy?

You nearly stole my thunder there because you were talking about politics.

I think the low prices of the pump are going to be that thing because we’ve got the midterm elections coming up at the end of next year. President Trump is laser-focused on keeping prices at the pump down, not just to give his base some money back into their pockets, but he’s also using it as a lever to try and keep inflation down. So I think we’re going to see even lower prices next year for prices at the pump.

Even lower prices. I don’t know how you can continue to produce as prices continue to fall.

I know, but we’re seeing it come through. Prices are now in the in the 50s for WTI, that U.S. benchmark, and yet oil production continues to chug along. So, higher supply means that the prices should remain in check.