From KERA News:

Tax-free weekend starts Friday in Texas. The three-day break lets families buy backpacks, sneakers and blue jeans with no sales tax, which seems like a straightforward way to save.

Brakeyshia Samms is a state policy fellow with the Center for Public Policy Priorities, a research group in Austin. She’s a self-titled “unapologetic tax policy wonk” and she says the tax holiday is a bad deal for Texas families.

Here are her five reasons why she says that’s the case.

1. They favor families with more money to spend: “For families who live paycheck to paycheck, it’s very difficult to time your purchases because you have rent, you have groceries that you need every month,” Samms says. “So wealthier families have the luxury of timing their purchases for the weekend of sales tax holidays because they have that extra cash flow.”

2. Some stores jack up prices for sales tax holidays: “Stores will actually have a better deal the week before tax-free weekend holidays, or the week after,” she says. “They mark stuff up and they water sales down.”

3. The holiday is open to tourists and residents in nearby states: “They’re not a contributing member to our state economy, which isn’t helpful for hard-working Texas families,” Samms says.

4. The state takes a big revenue hit: “So, the tax sales holiday, you lose about $70 million a year,” Samms says. “And so if you have that revenue plus other things with tax policy you can invest in those services that are really, really critical to families living paycheck to paycheck.”

5. They don’t help the economy grow: “Consumers actually don’t spend more, they just time their purchases differently. So if there was no sales tax holiday, they would have bought the purchase any weekend,” Samms says.

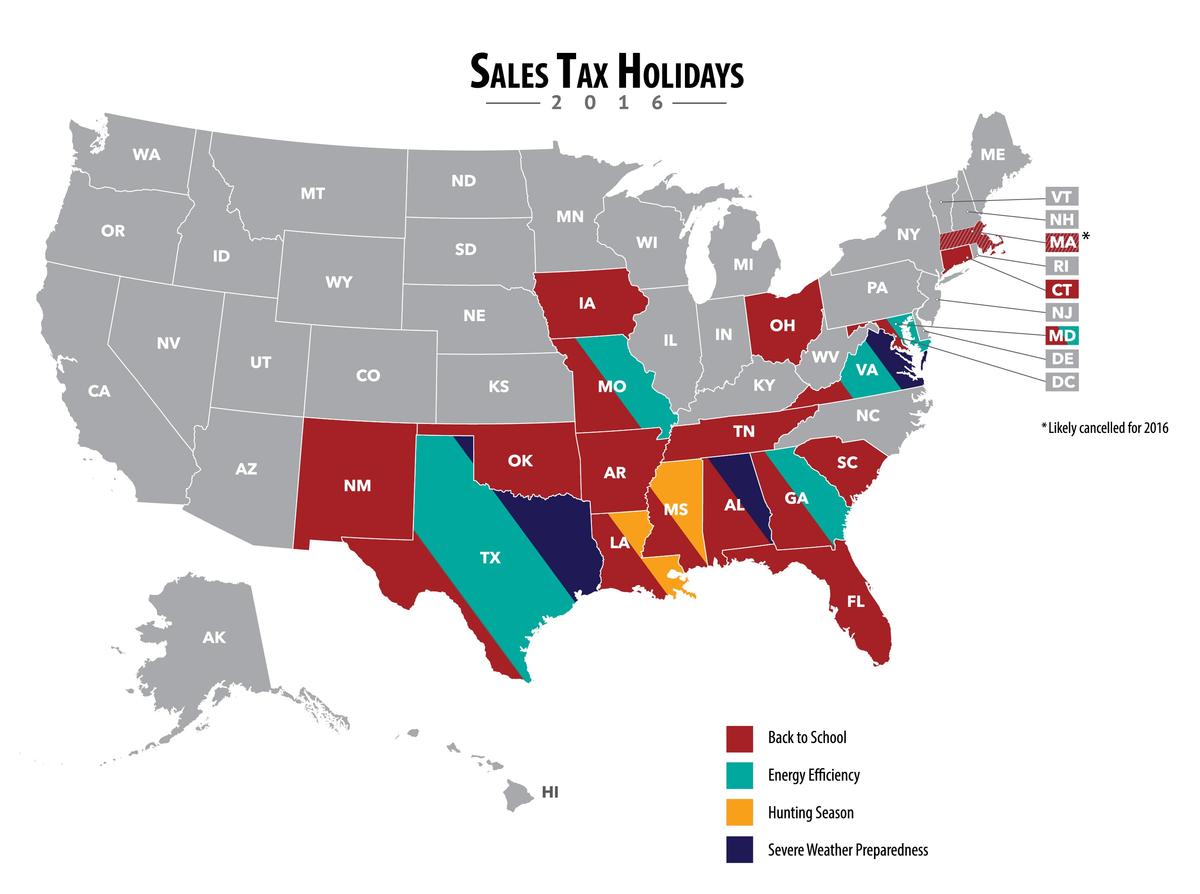

Sales Tax Holidays Across The Country

Check out this map of all the U.S. sales tax holidays, back to school and otherwise, from the Institute on Taxation and Economic Policy.

Click to enlarge.