Student debt has become a crisis, and recent reports indicate that it’s unlikely to get better. Last year, 70% of college students graduated with an average debt of $30,000. Many students won’t be able to pay their debt off until they’re over 60 years old. College debt will follow others to their graves.

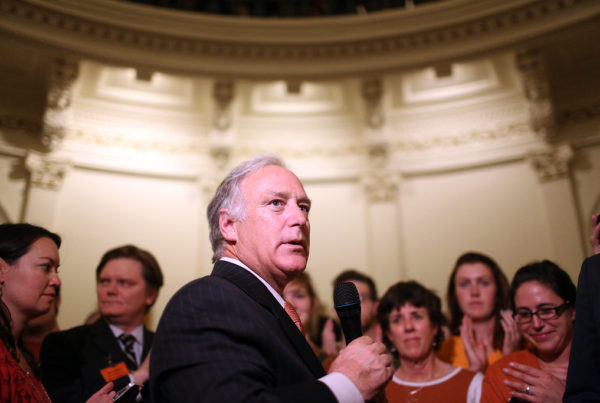

Walter V. Wendler, president of West Texas A&M University, says it’s time to inform future students about the effects of the debt they incur while in school. Wendler has spoken to high school students across the Texas Panhandle, offering one piece of advice: don’t borrow.

“One of the major purposes of a college education is to make progress as a citizen – to get a job, to buy a house, to have a family … and debt impedes the potential of many of those things,” Wendler says.

Wendler says what’s caused debt to increase so dramatically for students is the dramatic rise in tuition and living expenses.

What you’ll hear in this segment:

– How students can lessen the need to borrow money by going to community college

– Why older people are still paying off college debt

– Why a college education is sometimes not worth the amount students and their parents borrow

Written by Shelly Brisbin.