When was the last time you stepped foot in an office for work?

If you’re like many folks these days, the answer to that question could be something like “a while ago.”

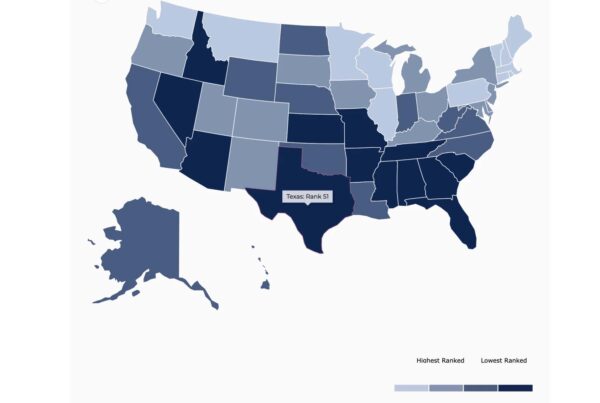

If that describes your current work situation, turns out you’re not alone. Major Texas cities like Houston, Dallas and Austin rank among the top places in the U.S. when it comes to office vacancies, according to reporting by Konrad Putzier.

He’s a reporter with the Wall Street Journal and he joined Texas Standard to talk about why so many Texas cities have empty offices. Listen to the interview above or read the transcript below.

This transcript has been edited lightly for clarity:

Texas Standard: According to your reporting, Houston, Dallas and Austin all had about 25% of their available office space empty. How does that compare with other cities and why so much empty space in Texas?

Konrad Putzier: So Texas actually has the highest leasing vacancy rates in the country, and they’re by some measure worse than San Francisco, worse than New York, which is surprising.

And I think one thing we need to address is that there are two types of vacancies, right? There is the physical vacancy – how many people are actually in the office on a given day. And by that measure, the Texas cities are actually doing pretty well compared to the rest of the country.

But then there is the leased vacancy, meaning what percentage of the office space in the city has no tenants. And on that measure, Texas is basically the worst in the country. And that’s what’s really surprising, right? Because you’d think if people are physically willing to go to the office, why won’t companies lease space? What’s going on there?

Well, you know, Texas has been bringing in a lot of folks from other states. Certainly during the pandemic, it seemed like we experienced major, major growth, certainly in terms of our demographics, population. I’m wondering if, in fact, this might have something to do with overbuilding. I know there’s been a lot of construction here in Texas to accommodate all the newcomers.

You hit the nail on the head.

So real estate is a cyclical business, especially office construction. During good times, developers tend to build too much. And then when the market crashes, you sort of sit on all this office space that you don’t know what to do with.

And Texas has always been the most extreme example of that, because land is relatively cheap compared to places like New York and San Francisco. There’s also less red tape. It’s just easier and faster to build. And what that means is basically that in times like the eighties, in times like the late nineties when the economy was doing very well and it was profitable to build, developers just built way too much office space and all that old office space is now competing with new buildings in cities like Austin that were built in recent years.

And what you have is the sort of mix where remote work is still impacting cities in Texas, even if they’re doing relatively well. There’s still remote work as an issue. And on top of that, you have this oversupply, this glut of office buildings. And you take those two things together and you have a lot of leasing vacancies.

» GET MORE NEWS FROM AROUND THE STATE: Sign up for Texas Standard’s weekly newsletters

You mentioned a company called Granite 190 in the suburbs of Dallas, an example of what these mass vacancies can look like in the real world. Could you say more about them?

Yeah, that’s kind of a typical example of the struggling office building right now.

It’s this old suburban office park that was built around 20 years ago, maybe a little bit older. And it has a giant parking lot around. It is surrounded by fields and it lost its main tenant this summer. And it’s partly vacant now and it’s in real financial difficulties.

Those are exactly the types of buildings that are struggling right now because companies, when they lease office space, they clearly prefer newer buildings and they prefer buildings in urban neighborhoods where their employees can walk around and go to a restaurant around the corner and maybe bike to their apartment or whatever the situation might be. And these old suburban office parks just aren’t in demand anymore. And there’s just so many of them right now that it’s kind of unclear what’s going to happen with them.

At the macro level, the Wall Street Journal’s done some really interesting reporting on a doom loop in commercial property. A lot of buildings financed, and if owners can’t make payments, well, we’d be looking at a wave of defaults in the not too distant future and banks would be holding the bag. A lot of regional banks, in fact, hold that kind of commercial property debt. It reminds me a bit of what triggered the meltdown in 2007-2008. Is there a danger, these empty offices or a sign of a wave of defaults to come?

There is a real danger.

I think the big difference between now and 2008 is that the housing market is just a lot bigger than the office market. There’s just a lot more value, a lot more debt tied to homes than there is to office buildings.

So that’s the good news, right? Even in the worst case scenario, it’s much smaller than the housing market. But I think the fundamental issues that the office market faces are maybe even way worse than the housing market. And in 2007 and 2008, because there wasn’t any fundamental shift away from the home in 2008, demand for housing was always there. Whereas now you have this fundamental shift for companies that just need and want less office space.

On top of that you have rising interest rates and all these other issues that pushed down building values. And there’s a real risk that this will impact lenders and banks are way more exposed to the office sector and commercial real estate than most people know. They don’t just lend directly, they issue mortgages against office buildings which are in trouble now. They also indirectly lend against these office buildings that they will lend to finance companies, which will then issue mortgages.

And on paper it looks like some debt funds and private equity company that’s lending against the building. But ultimately the money comes from a bank and it might be the bank that’s left holding the bag. So that’s the real risk that there is this contagion to the financial sector, some weakness in the commercial real estate market.

You see a way out of this spiral?

If somehow people all decide to go back to the office, I guess that would be the easiest way out of all this.

One big question mark is interest rates, right? Because remote work is probably not going to go away. But if the cost of debt goes down again significantly soon, for whatever reason, that would be a game changer. And that could really help stabilize the commercial real estate market because rising interest rates have been a huge issue here.

And then in terms of remote work, it’s still a question mark as to how big a factor it will be. Everyone agrees that more people will work remotely in the future, but will that, you know, push up vacancy rates by 20% or by 30% or 40%? Those are big differences between those ranges. And I think if it turns out that buildings will be fuller than we anticipated, that could also have an impact.

But fundamentally, I think everyone agrees that the office sector is in trouble.