Finda Koroma has lived in her spacious brick four-bedroom home in Mesquite since 2005. She bought one of the first homes built in The Hills at Tealwood neighborhood.

The 68-year-old home health nurse from Sierra Leone has been renovating the house, bit by bit, every time she’s scraped together enough money to pay the contractor. Her plan was to sell the house to fund her retirement.

Instead, she’s facing eviction after her homeowner’s association board — some of her neighbors — voted to foreclose on her house and sold it to recoup a $3,542.64 debt.

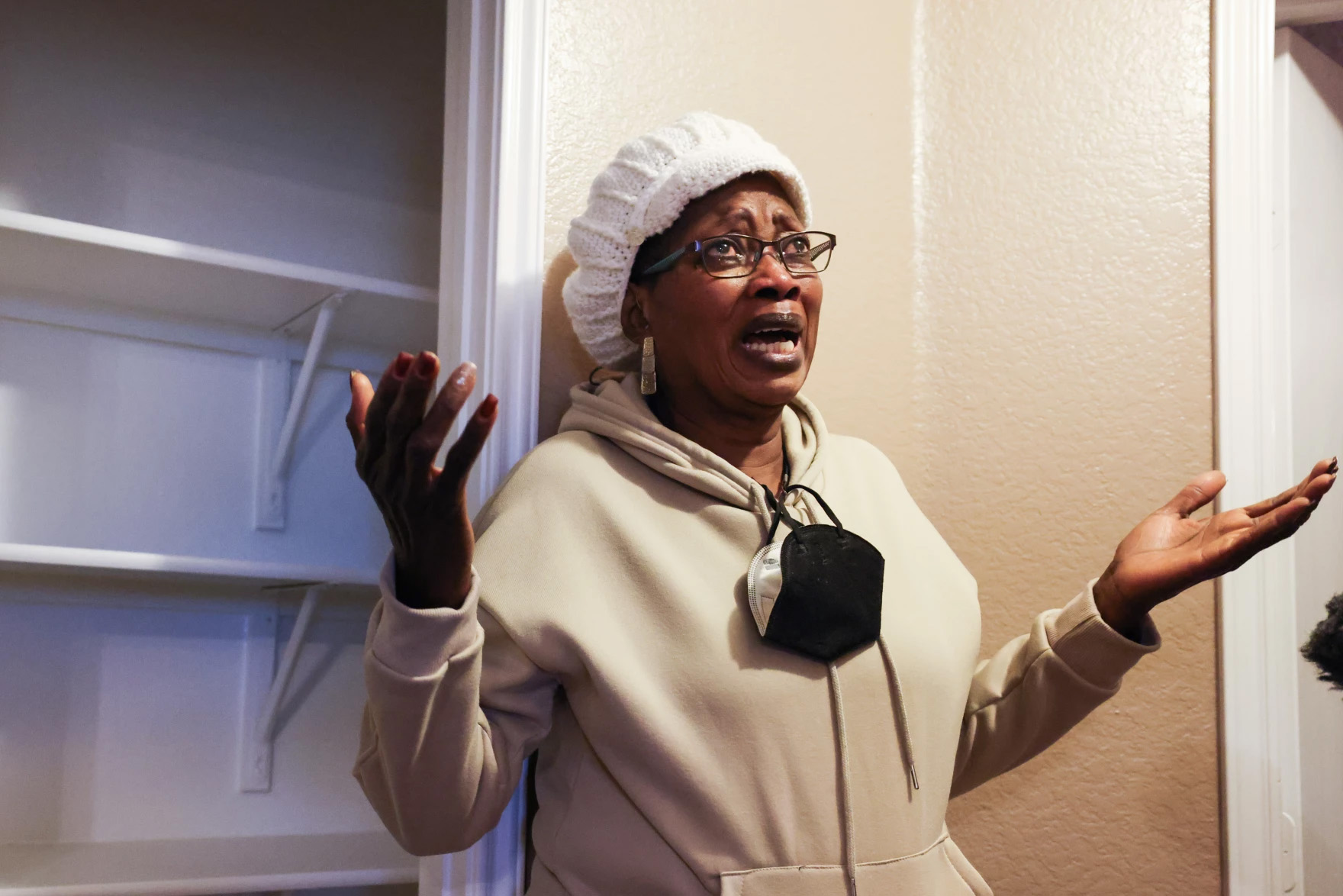

“I’ve been here all these years, worked my butt off…and then all of a sudden somebody can just come overnight and take everything away from you? Just like that?” Koroma said.

Jason Reed, a lawyer for The Hills at Tealwood HOA, said that was the remedy the association had available to them.

“Unfortunately, from time to time, they have to utilize that remedy in order to recover funds that are that are owed to the association that haven’t been paid,” Reed said.

When residents don’t pay the HOA fees that cover the costs of operating the association and maintaining shared amenities, Reed said, “the other people in the community are effectively carrying the burden of that person not paying.”

Now, Koroma said she barely sleeps because she’s so stressed out. She doesn’t know where she’ll go if she’s forced to leave her home. She vacillates between outrage and despair at the thought of losing her home, which Zillow estimates is worth about $340,000.

“This is a daylight robbery,” Koroma said.

Foreclosure rules

It’s not clear how often HOAs foreclose on their residents. Texas does not track these cases.

According to the Community Association Institute, an industry organization, 1 in 3 owner-occupied homes in Texas are governed by the 21,000 associations operating in the state. These nonprofit associations have broad powers to set and enforce their own rules beyond local laws and ordinances. An HOA’s terms are typically set by a subdivision’s developer long before anyone even buys a home.

“Those rules run with the land. You buy the land, and you’re subject to those HOA rules,” said Nick Veach, an attorney specializing in HOA lawsuits. “And all HOAs give a right to foreclose”

Under Texas law, an HOA has to follow a handful of steps before it can get a court’s approval to foreclose on a homeowner. In many cases, HOA rules authorize an expedited approach that avoids a full lawsuit.

“Once they convince a judge that [the resident] is properly served with a citation, which means she’s been notified she’s been sued, and she doesn’t appear in court or file any type of answer, the lawyer just sends an order and the judge signs it,” Veach said.

At that point, the HOA has the right to sell the home.