From KUT:

In the parking lot of a two-story apartment building in Central Austin last month, former and current politicians came together to celebrate something increasingly rare in this city: low rents.

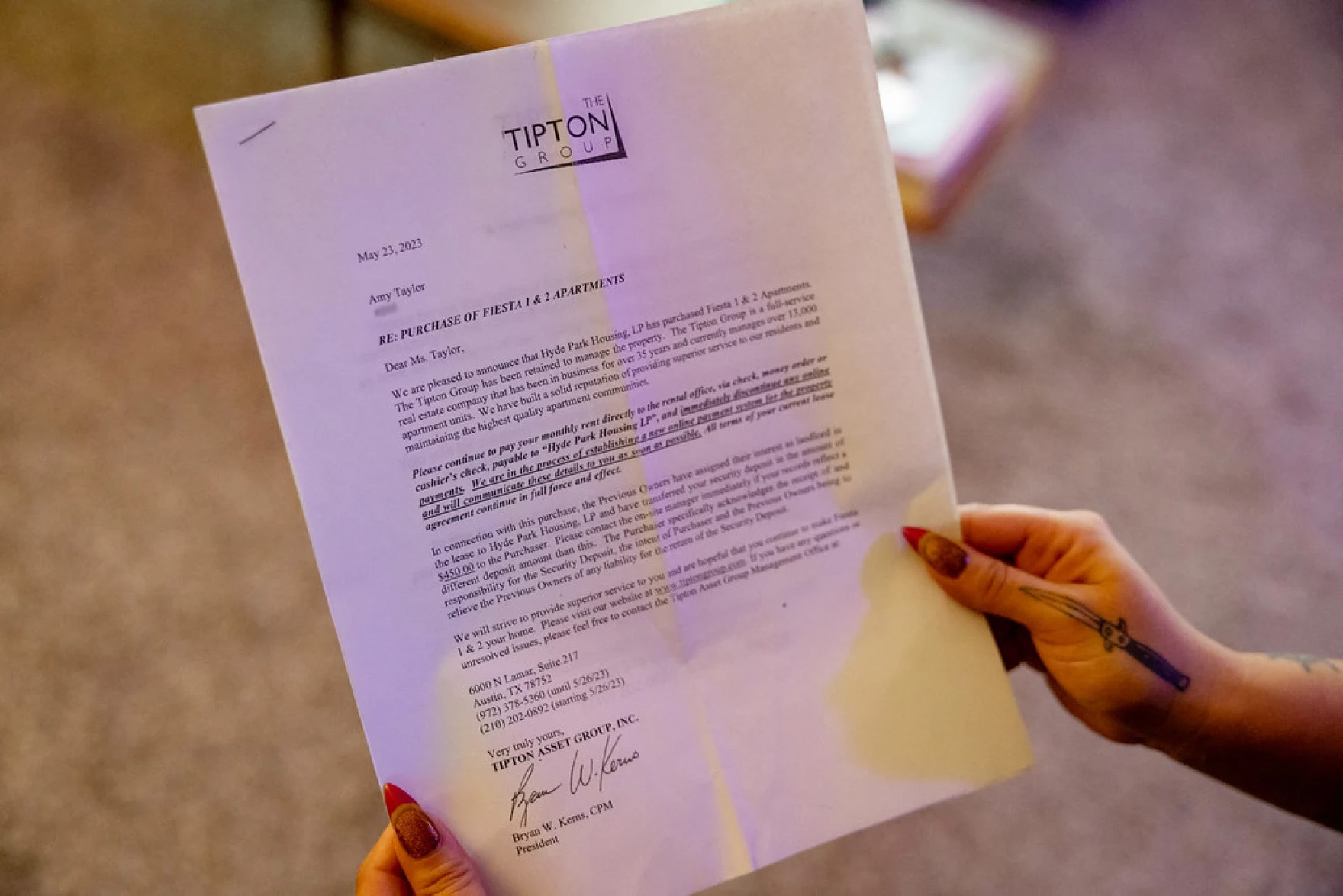

The city, along with a real estate investment fund, had bought seven apartment complexes in some of Austin’s priciest neighborhoods. They planned to save these old, cheap homes from the threat of redevelopment or demolition.

“The challenge of affordability requires us to be dedicated, focused and relentless,” former Mayor Steve Adler said at the gathering on that humid October morning. He addressed about three dozen former colleagues, staff members and activists, who nibbled on pastries and sipped hot coffee from disposable cups. “But it also requires us to be clever and to be smart because the challenge is so great.”

In the apartments the city purchased are old appliances, shag carpet, wood paneling, popcorn ceilings. But with lackluster interiors comes cheap rent. It’s a compromise renters understand intimately. Put up with delayed maintenance and shabby interiors in exchange for paying less than your neighbors. By buying up these properties, the city and its partner would keep bargain rents down and help low-wage workers stay in Austin.

That fall day was a chance to memorialize this achievement. Wearing a suit, Adler tugged on a rope attached to a tarp hanging across the front of the Hyde Park apartment building. It came swirling to the ground to reveal his own name, now affixed to the side of the building: The Adler.